Greetings to you all readers, in this article i will be discussing what exactly this brand new and groundbreaking innovation(Block66) is all about and i will appreciate your standing by till the end.

Thanks to the world of technology mixed with the innovation of this company (Block66) making it possible for the success of this platform and standing it out in the wild of Cryptocurrency with its exceptional cutting edge effort, as a corner stone and swift transformation to evolve

BLOCK66 OVERVIEW

BLOCK66 OVERVIEW

The Mortgage sector is one of the remaining important sectors that has endured a steady shift in technology and innovation. Despite the banking industry’s possession, the latest wave of block technology has the potential to cut them off.

Block66 presents the primary stage where loan specialists can get to a marketplace of checked borrowers searching for contract fund. This marketplace is open, straightforward, and exceptionally computerized, so loaning is streamlined, with bring down expenses, and lower dangers. Each advance is spoken to as a pool of “Proof of Location” (PoL) tokens that can be separately exchanged to speculators, giving loan specialists liquidity, and enabling a various pool of speculators.

Block66’s blockchain and smart-contract technology makes it feasible for loaning contracts to be tokenized, and the adaptability and liquidity gave by Block66’s benefit upheld tokens will open the contract market to a more different pool of financial specialists. Each advance has its own smart contract, in charge of stamping, offering, and following responsibility for PoL tokens. Block66’s cyptographically-anchored smart contracts guarantee the market remains open, straightforward, and alter evidence.

iSSUES

Since the financial crisis, traditional mortgage lenders have considerably tightened the lending criteria. To a large extent, this was a fair reaction to over loans. However, the restrictions imposed also have limited lending to borrowers previously served by traditional financial service providers and who were able to repay the mortgage. Since the mortgage loan has been boosted for people who can not meet the standard insurance criteria.

Along with the abolition of mortgage criteria, the nature of work is also changing: fewer borrowers meet the standard insurance criteria due to the nature of their business, and many claims to have difficulty obtaining mortgages because of their nature. the atypical character of their employment.

The non-premium market segment is currently often used by non-traditional lenders, primarily family offices and high net worth, which brokers offer the possibility of lending. In all regions of the world, this market is highly segmented, non-transparent and slow. There are many examples of fraud and misinterpretation of consumers.

In the mortgage market lack transparency, borrowers are forced to trust brokers implicitly and have no possibility of checking the number of lenders represented by their application. In some countries, the market is largely segmented, and hundreds of active lender-based lenders operate in the area, making it virtually impossible to cover an unauthorized broker.

On average, the mortgage application process lasts for several days. An important part of this time is the collection of necessary documents and subsequent exchanges between the borrower and the lender, providing additional information and corresponding to the requirements. This process is very ineffective, stressful for borrowers, and it does not take full advantage of available automation technologies for many manual steps and an optimized workflow.

High fees, capital requirements and the lack of a transparent trading market serve to limit most investors in MBS trading. Institutions and a small percentage of private lenders associated with the ecosystem of mortgage brokers are the only active investors in the area. Significant amounts of capital remain blocked or deployed in other instruments.

SOLUTION

Block66 is the first platform where lenders can access marketed borrowers seeking mortgage financing. This market is public, transparent and highly automated, so loans are simplified, with lower costs and lower risks.

The Block66 platform will introduce operational efficiency and automate as much as possible to optimize the use of mortgages and the process of facilitation. While Block66 believes in technology, some loan cases are customized and better managed by human agents. To solve these cases, Block66 will gather a network of virtual subscribers who will digitally check the documents. By combining the power of automation with the use of human subscribers, if necessary, Block66 strives to provide the best user experience for all parts of the platform.

Utilizing the existing technology for automatic verification and verification of documents and application data, Block66 can do a lot to protect against fraud. Most mortgage fraud is committed by a borrower or broker, and lenders and insurers do not take them into consideration due to a large number of documents involved and time constraints. Block66 systems will feature controversial articles for virtual subscribers and lenders, which will greatly facilitate the detection of fraud.

All Block66 lenders will advance lending criteria in advance, creating a seamless platform where brokers can send requests. The Block66 platform will be able to browse hundreds of loan offers in order to find the best possible offer for brokers and debtors.

All the mortgages provided by Block66 have been released in blockchain and are also reflected in the physical world through the Digital Trust Fund. Over time, the lenders will be able to market the tokens on the exchange platform that is specifically designed for that purpose in the context of ownership or exchange exchanges developed by the partner. The ability to divide credit agreements into smaller credit fractions reduces the entry barrier to small investors, increases liquidity at home and secures investment in this type of asset for investors. all types of investors.

Block66 wants to become the most sophisticated platform in the world so brokers and lenders will work effectively for the satisfaction of borrowers. All loans will be issued in the blockchain, and the funds will be drawn through the obtained intelligent contract. All documents pertaining to a mortgage transaction will be verified and stored in a chain of blocks that provide unchanging history and authenticity. Storing the hash loan documents secures the full transparency of the lender and the borrower while generating a much clearer time during regulatory control and on-the-spot checks.

TOKEN DETAILES

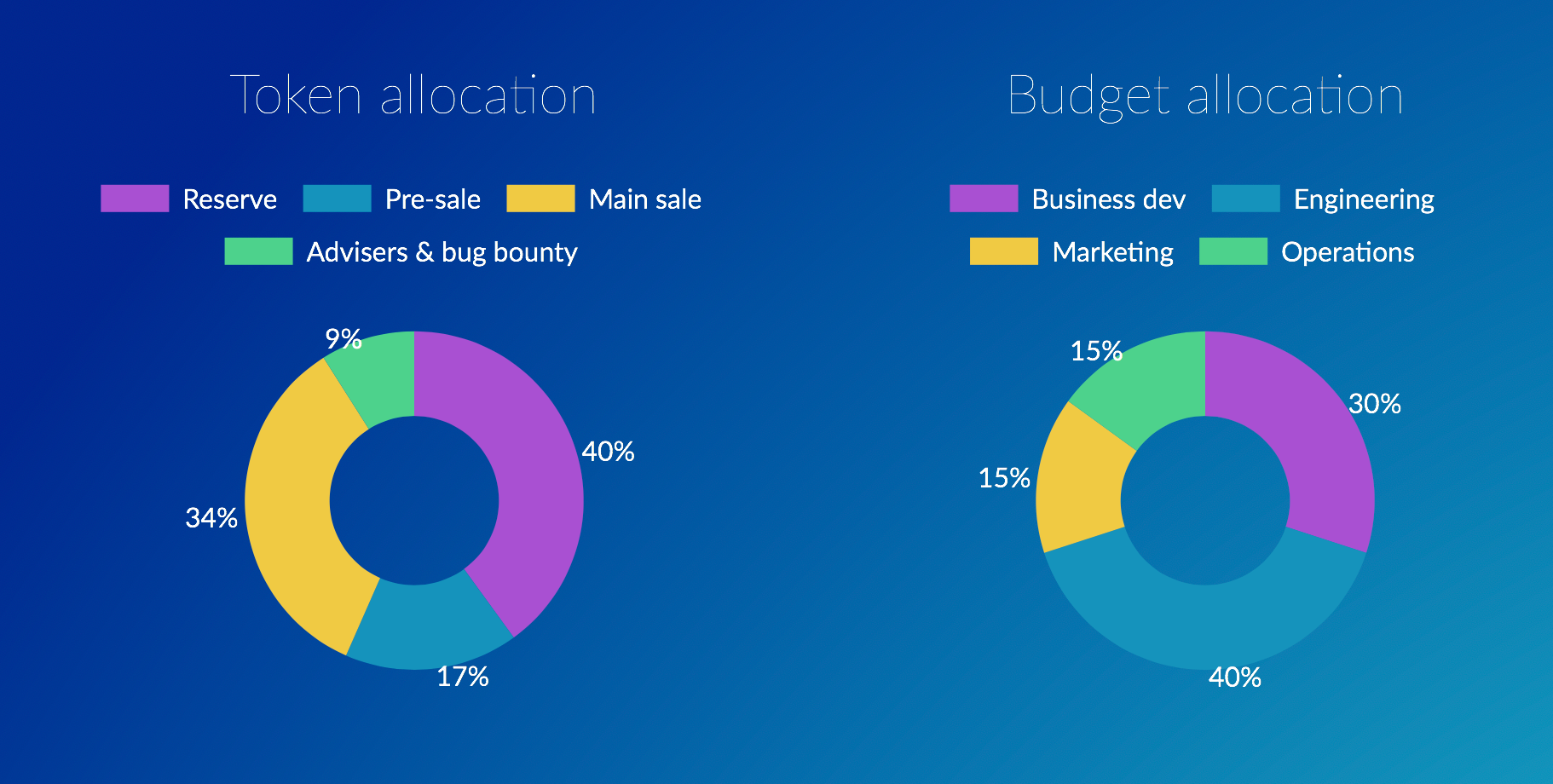

B66 is a limited supply token that when stored in a special smart contract generates the network’s native token – BNET, that is then sold via the platform to network users (i.e mortgage brokers). The revenues generated by the sale are distributed to BNET holders.

B66 is a limited supply token that when stored in a special smart contract generates the network’s native token – BNET, that is then sold via the platform to network users (i.e mortgage brokers). The revenues generated by the sale are distributed to BNET holders.

ICO PARAMETERS

Token B66

PreICO Price 1 B66 = 0.10 USD

Price 1 B66 = 0.15 USD

Platform Ethereum

Accepting ETH

Soft cap 3,000,000 USD

Hard cap 20,750,000 USD

Country Singapore

Whitelist/KYC KYC

Restricted areas USA, Canada, China, Iran, North Korea

PreICO Price 1 B66 = 0.10 USD

Price 1 B66 = 0.15 USD

Platform Ethereum

Accepting ETH

Soft cap 3,000,000 USD

Hard cap 20,750,000 USD

Country Singapore

Whitelist/KYC KYC

Restricted areas USA, Canada, China, Iran, North Korea

TEAM

ROADMAP

Q1 2017

Block66 is conceived. Work begins on drafting the whitepaper and contact is made with some early advisors and team members.

Q4 2017

WORK BEGINS

Planning work begins on the Block66 platform. User journeys and operating flows are designed for the matching engine.

Q2 2018

TOKEN GENERATION EVENT (TGE)

TGE launch coming soon. Office build out begins. Wireframing and prototypes of platform produced.

Q3 2018

DESIGN AND DISTRIBUTION PHASE

Ramp up marketing and business development efforts. Form “Block66 Alliance” of customers. Move aggressively into product planning and design.

Q4 2018

BUILD PHASE

Alpha testing phase with first customers using the platform. First “Block66 Alliance” report.

Q1 2019

RELEASE PHASE I

MVP Launch, with first batch of on-chain loans funded and distributed via the network.

Q3 2019

RELEASE PHASE II

Loan tokenisation. Network users can trade on-chain securities on a fractional basis, with smart contracts ensuring that loan repayments are distributed to all token holders.

For more detailed informations, visit:

Website – https://block66.io

Facebook – https://www.facebook.com/Block66Official

Twitter – https://twitter.com/Block66_io

LinkedIn – https://www.linkedin.com/company/block66/

Reddit – https://www.reddit.com/r/Block66/

Medium – https://medium.com/@block66

Bounty0x Username: Joecolern

Comments

Post a Comment