Greeting to you all readers, i'm here again to give you another exciting topic called Carbon Chain and i will appreciate your attentiveness.

Blockchain technology revolutionized the view on conventional fiat currencies as it enables the mining of decentralized digital currencies. The introduction of Bitcoin changed the world and became the gold standard. Although acceptance of cryptocurrencies among the wider public is still proving challenging as some providers are associated with reputational issues. The overall shift to digital currencies is progressing slowly, and this breakthrough technology has yet to reach its full potential. Blockchain is more than just an aspect of cryptocurrencies. Blockchain technology has wide ranging applications and simplifies business and transaction processes, provides transparency and safety, makes centralized intermediary parties unnecessary and reduces transaction costs. However, blockchain technology-based business models greatly depend on stable energy supply

CARBON CHAIN OVERVIEW

The Carbon Chain project aims to build a decentralized platform backed by block-chain technology where 'Carbon Credits' can be exchanged by both public (even, governments) and private firms and institutions. Through an exchange hosted on the Carbon Chain platform, Carbon Credits can be sold at a discounted rate by using its block chain-powered Carbon Credit Exchange (CCX) and the Carbon Chain Token (CCT).

INTRODUCING 'CARBON CREDIT

A carbon credit is a tradeable certificate or permit which allows the holder the right to emit 1 tonne of CO2 or another greenhouse gases with an equivalent of 1 tonne of CO2. The issuance of carbon credits aims to reduce the emission of greenhouse gases into the atmosphere.

One of the main issue facing the mankind is that of Global WARMING. In short definition, Global warming is the rise within the average temperature of Earth’s atmosphere and oceans. Carbon credits and carbon markets square measure a part of national and international makes an attempt to mitigate the expansion in concentrations of greenhouse gases (GHGs). The goal is to permit market mechanisms to drive industrial and industrial processes within the direction of low emissions or less carbon intensive approaches than those used once there's no price to emitting carbon dioxide and alternative GHGs into the atmosphere.

If you’re confused of what a carbon credit means, it simply means a permit or certifi cate allowing the holder to emit carbon dioxide or other greenhouse gases. The credit limits the emission to a mass equal to one ton of carbon dioxide. The issuance of carbon credits aims to reduce the emission of greenhouse gases into the atmosphere.

The carbon chain company is owned by a respected individual who have been in the sector for many years, they are creating this platform to help counties keep up their Paris agreement about keeping an ecological climate.

The carbon chain company is owned by a respected individual who have been in the sector for many years, they are creating this platform to help counties keep up their Paris agreement about keeping an ecological climate.

'CARBON CREDITS' MARKET

With stringent controls expected to be applied in future to deal with the subject of 'climate change', the Carbon Credits market is going to explode.

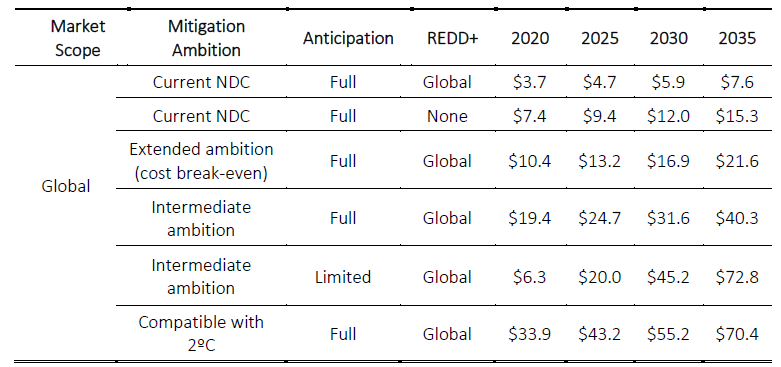

Considering the ambition levels of targeting CO2 levels of the "NDC (i.e. each nations current 'Nationally Determined Contributions' (NDC) pledges)", “intermediate,” and “2°C” scenarios at 77, 185, and 249 billion tons of CO2 and CO2 equivalent, respectively, the carbon trading market is expected to be worth more than trillion dollars by 2035.

Carbon Chain is assured that block chain technology and CCT can change a social, environmental, property, and important distinction to the impact of global climate change with a selected concentrate on girls and youth upliftment. And fi nally, proving there's no ‘double accounting’. Most crypto currencies these days don'toff er a true world resolution or worth for the fashionable world.

You may be wondering how they make their transaction, and how they chive this. Find how it works below:

You may be wondering how they make their transaction, and how they chive this. Find how it works below:

- Carbon Chain finds a potential carbon credit project

- Carbon Chain invests in the registration and issuance costs.

- The project is registered and the carbon credits issued.

- The carbon credits are placed on the Carbon Credit Exchange (CCX)

- A Carbon Chain client signs a contract to buy the Carbon Credits

- The client pays Carbon Chain 70% of the contract cost in cash/ ETH in exchange for the required amount of Carbon Chain Tokens held by the company

- The Client purchases 30% of the contract cost in Carbon Chain Tokens.

- Client purchases Tokens from public Token Exchanges. Either by themselves or the use of an intermediary.

- Client sends Tokens to Carbon Chain in exchange for the carbon credits. 10. Client uses carbon credits with which they retire against their tax or target

CARBON CHAIN TOKEN

ICO PARAMETERS

- Symbol - CCT

- Maximum Token Supply - 550 million CCT (The total token supply is fixed)

- No. of Tokens Available for Sale - 341 million CCT (i.e. 62% of token supply)

- Payment Method - ETH, USD, Fiat Currencies

- Token Standard - ERC-20

Private Sale

Start Date - 1st Sep '18 ||| End Date - 20th Nov '18

Soft cap - $ 480,000

Hard cap - $ 7.26 million**

No. of Tokens Available for Sale - 121 million CCT

Token Pricing - 1 CCT = USD 0.06 (i.e. 40% discount) plus 10% bonus tokens

CROWD SALE

Start Date - 21st Nov '18

Hard cap - $ 22 million

No. of Tokens Available for Sale - 220 million CCT

Token Pricing - 1 CCT = USD 0.10

Hard cap - $ 22 million

No. of Tokens Available for Sale - 220 million CCT

Token Pricing - 1 CCT = USD 0.10

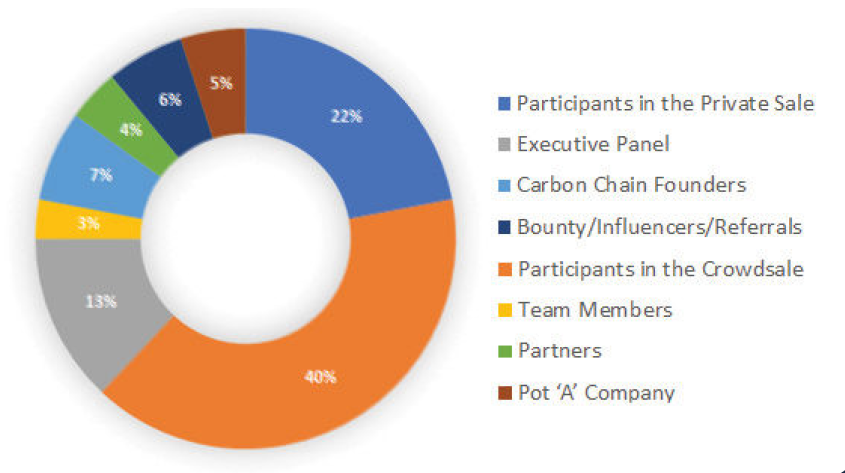

DISTRIBUTION OF TOKEN

ROADMAP

CARBON CHAIN TEAM

Website: https://carbonchain.org

Whitepaper: https://carbonchain.org/wp-content/uploads/Carbon-Chain-White-Paper-21-Aug.pdf

Lite Paper: https://carbonchain.org/wp-content/uploads/Carbon-Chain-Lite-Paper-21-Aug-2018.pdf

Facebook: http://www.facebook.com/sharer.php?u=https%3A%2F%2Fcarbonchain.org&t=Carbon%20Chain

Twitter: http://twitter.com/share?text=Carbon%20Chain&url=https%3A%2F%2Fcarbonchain.org&via=carbon_chain

Comments

Post a Comment